Should You Buy Popular Vehicles And Services Ltd Shares? Detail Analysis

Popular Vehicles and Services Ltd (PVSL) operates India’s leading integrated automobile dealership network focused on passenger, commercial, and electric vehicles. With the recent filing of IPO draft papers to raise ~Rs.600 cr, investors are evaluating whether PVSL offers a value-buying opportunity.

In this detailed analysis, we assess PVSL’s fundamentals, growth levers, risks, and reasonable valuations compared to peers Landmark Cars and Mahindra First Choice Wheels to provide perspective on the upcoming IPO.

Popular Vehicles & Services IPO ANALYSIS

Popular Vehicles and Services Ltd (PVSL) has filed draft papers with SEBI for an Initial Public Offering to raise approximately Rs.600 crores. The IPO comprises a fresh issue of equity shares worth Rs.250 crores and an Offer for Sale of shares aggregating up to Rs.351.55 crores by existing shareholders.

PVSL has set the price band for its IPO at Rs.280-295 per equity share. At the upper end of the price band, the company will have a post-issue market capitalization of Rs.2,050 crores. Popular Vehicles IPO will open for subscription on March 12, 2024, and close on March 14, 2024.

Leading brokerages like BP Wealth, Canara Bank Securities, and Ventura Securities have recommended investors to SUBSCRIBE to the IPO, citing PVSL’s integrated dealership model, leadership in key markets, and partnerships with auto majors as strong positives.

Key Details About Popular Vehicles and Services Ltd

Founded in 1983 and led by John K Paul, Francis K Paul, and Naveen Philip, Popular Vehicles and Services Ltd is an automobile dealership network catering to the entire lifecycle of vehicle ownership. Headquartered in Kochi, PVSL’s offerings span across:

- New vehicle sales • Used vehicle sales

- Servicing & repairs • Spare parts distribution

- Facilitating insurance/finance • Driving schools

PVSL operates dealerships in three vehicle categories: Passenger vehicles (including luxury cars), Commercial vehicles, and Electric 2/3-wheelers. The company’s showrooms retail Maruti Suzuki, Honda, Tata Motors, Jaguar Land Rover, and other popular auto brands.

As of December 2023, PVSL had a presence across four South Indian states with 61 showrooms, 139 workshops, 133 sales outlets, and 32 pre-owned sales outlets. Thanks to its 400+ retail touchpoints across Kerala, Karnataka, Tamil Nadu, and Maharashtra, the company has emerged as the #1 dealer for Maruti Suzuki in terms of sales volume.

Popular Vehicles and Services Financials

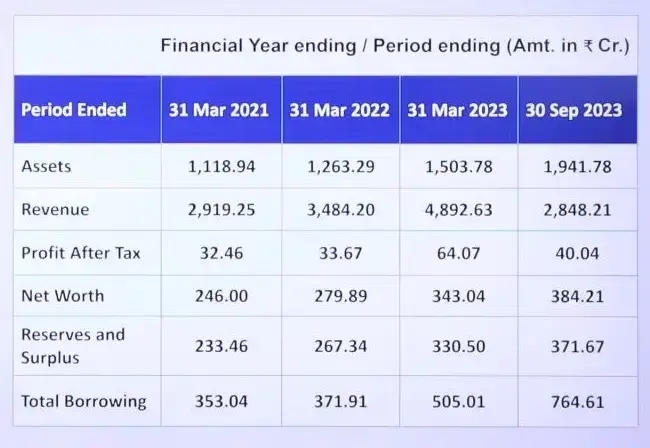

An analysis of PVSL’s financial statements reveals an impressive growth trajectory across all key parameters:

- Revenues have surged by 68% from Rs.2,919 crores in FY21 to Rs.4,893 crores in FY23

- Net Profit has almost doubled from Rs.32 crores to Rs.64 crores during this period

- Return on Equity has remained healthy between 19-20% despite rapid expansion

PVSL’s asset-light integrated model, focused on delivering service, spares, and accessories, enables it to earn higher margins and insulates it from volatility in vehicle sales.

The company’s H1FY24 financials also showcase robust execution with 55% revenue growth to Rs.2,835 crores and a 52% rise in net profit to Rs.40 crores compared to H1FY23.

Key Performance Indicators

Here are some of the key financial indicators that showcase PVSL’s track record of profitable growth:

- Revenue CAGR stands at 68% over three years

- Net Profit CAGR is 97% over three years

- Gross Margins have remained stable at ~15%

- Return on Equity of 19-20% highlights capital efficiency

- Debt/Equity ratio at reasonable levels below 1.5x

Thus, PVSL has judiciously leveraged its partnership with Maruti Suzuki to aggressively expand its dealership network while maintaining healthy profitability metrics.

Comparison with listed peers

PVSL has priced its IPO at a significant discount compared to listed industry peers like Landmark Cars and Mahindra First Choice Wheels:

| Company | Market Cap (Rs Cr) | Revenue (Rs Cr) | Net Profit (Rs Cr) | P/E | RoE |

| Popular Vehicles* | 2,050 | 4,893 | 64 | 23x | 19% |

| Landmark Cars | 1,140 | 1,809 | 57 | 43x | 24% |

| MFC Wheels | 780 | 986 | 31 | 25x | 15% |

Projected post-IPO annualized financials at the upper price band used for comparisons

Popular Vehicles has kept IPO pricing modest at 23x P/E despite stronger growth metrics than listed peers. Robust expansion is attractive for value buying Without compromising profitability or capital efficiency.

Despite a faster growth rate in revenues and profits over the last three years compared to listed players, PVSL has kept valuations modest, offering investors a value-buying opportunity.

Positive & Negative Factors to Invest in Popular Vehicles and Services Ltd

Positive Factors to Consider

These key positives underpin the PVSL investment case:

- Industry Tailwinds: Favourable demographics, rising incomes, increasing digitization, and under-penetration of vehicles provide abundant headroom for growth.

- Leadership: #1 dealer for Maruti Suzuki in terms of sales volume. An extensive network enables PVSL to keep gaining market share.

- Diversified Offerings: Presence across vehicle categories and lifecycle insulates against cyclical downturns in the auto sector.

- Asset Light Model: Company-owned showrooms, while most workshops operated on revenue share, resulted in a high return on capital.

- Strong Parentage: It is backed by Maruti Suzuki, Tata Motors, and other OEMs regarding technical expertise, inventory funding, and better credit terms.

Negative Factors to Consider

Here are some key downside risks for the company:

- Macroeconomic linkages: PVSL remains vulnerable to vagaries in consumer demand, liquidity, inflation, and interest rates.

- Working Capital intensive: Rapid expansion across locations exerts pressure on optimizing inventory and receivables.

- Execution challenges: Scaling up showrooms rapidly across regions poses risks of delays in breakeven and sub-optimal asset utilization.

- Client concentration: Over-reliance on Maruti Suzuki makes the company vulnerable to any change in strategy by Maruti.

- Competition: Crowded dealership space raises competitive intensity. Consolidation also poses risks of market share loss.

Conclusion

Backed by marquee partners and leadership in key markets, PVSL has proven its mettle by delivering brisk growth and healthy returns. The company is adequately capitalized to fund its expansion plans across the Western and Northern regions. While valuations seem fair and affordable compared to listed peers, investors should account for inherent cyclicality risks and competitive threats in the sector.

Nonetheless, PVSL’s IPO offers an excellent opportunity for investors with high-risk tolerance and investment horizon of over 3-5 years to SUBSCRIBE to the issue.

i’m going to invest right now! nice explaination